IRS 1127-A 2011-2026 free printable template

Show details

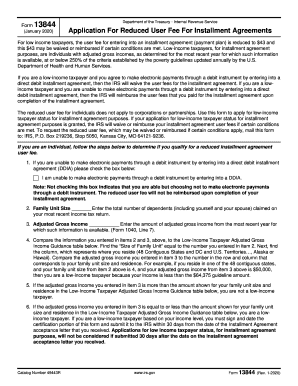

Form 1127-A Department of the Treasury Internal Revenue Service Application for Extension of Time for Payment of Income Tax for 2011 Due to Undue Hardship Last name OMB No. 1545-2131 2011 Your social

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs form 1127

Edit your form 1127 irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1127 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1127 irs form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1127 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

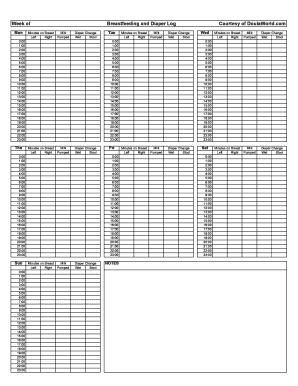

How to fill out 1127 form

How to fill out IRS 1127-A

01

Obtain a copy of IRS Form 1127-A from the IRS website or your tax professional.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide the necessary details about your income tax return, including the tax year you are applying for.

04

Indicate the amount of tax you owe and the reason for requesting an extension.

05

Include any supporting documentation that reflects your financial hardship.

06

Sign and date the form, then submit it to the appropriate IRS address.

Who needs IRS 1127-A?

01

Individuals who are unable to pay their federal income tax bill by the due date and who want to request an extension of time to pay.

02

Taxpayers who can demonstrate a genuine financial hardship that makes it difficult to pay their tax liability on time.

Fill

form

: Try Risk Free

People Also Ask about

Is a 1040 the same as a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

Are there 3 types of tax return forms?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS. Differences in the forms, however, could cost you if you're not paying attention.

What is a 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is a 1040 return form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Do I need a W-2 if I have a 1040?

Yes, you can still file taxes without a W-2 or 1099. Usually, if you work and want to file a tax return , you need Form W-2 or Form 1099, provided by your employer. If you did not receive these forms or misplaced them, you can ask your employer for a copy of these documents.

When must a return be filed?

For this year, e-file opens on January 23, 2023. You'll have until the annual due date to file your return on time. If you need more time, you can file an extension and the IRS will accept 2022 returns until the extension deadline, which is generally Oct. 15.

What is the return filing?

[As amended by Finance Act, 2022] FILING THE RETURN OF INCOME. The taxpayer has to communicate the details of his taxable income/loss to the Income-tax Department. These details are communicated to the Income-tax Department in the form of return of income.

When can I file taxes 2023?

IRS sets January 23 as official start to 2023 tax filing season; more help available for taxpayers this year | Internal Revenue Service.

What is the use of returns filing?

If you do not file an Income tax return, you cannot carry forward or set off your losses. Filing of the Income-tax return not only helps you but also helps the nation. The tax that you pay is used by the government to build infrastructure and to improve other facilities of the nation such as medical, defence, etc.

What is the meaning of return filing?

[As amended by Finance Act, 2022] FILING THE RETURN OF INCOME. The taxpayer has to communicate the details of his taxable income/loss to the Income-tax Department. These details are communicated to the Income-tax Department in the form of return of income.

Fill out your IRS 1127-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1127-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.