Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Return filing is the process of submitting documents to the government or other regulatory body in order to fulfill a legal requirement. It typically involves submitting documents such as tax returns, financial statements, and regulatory filings. Return filing can also involve submitting forms to receive refunds or credits for certain taxes.

What is the purpose of return filing?

The purpose of return filing is to ensure that taxpayers are compliant with the laws and regulations of the taxation authorities. It is also used to calculate the amount of tax that the taxpayer owes for a particular period. Return filing is one of the important steps in the taxation process, which helps to ensure that the government collects its due amount of taxes from the taxpayers.

What information must be reported on return filing?

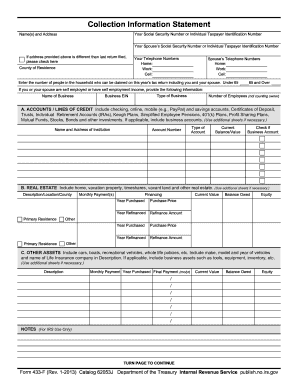

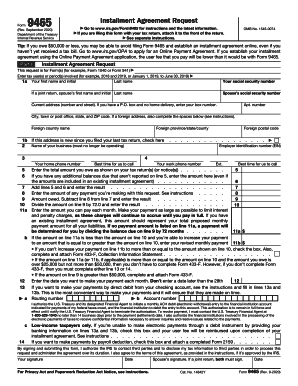

The information that must be reported on a tax return filing varies depending on the type of tax return. Generally, tax returns require the filer to provide information about their income, deductions, and credits. Taxpayers may also need to provide information about their investments, dependents, and other financial accounts. In addition, taxpayers may need to submit copies of certain documents, such as W-2 forms, investment statements, and proof of payment of estimated taxes.

When is the deadline to file return filing in 2023?

The deadline to file tax returns for tax year 2023 is April 15, 2024.

What is the penalty for the late filing of return filing?

The penalty for late filing of a tax return is 5% of the unpaid taxes for each month (or part of a month) that the return is late, up to a maximum of 25% of the unpaid taxes. There is also a minimum penalty of $135 or 100% of the unpaid taxes, whichever is smaller.

Who is required to file return filing?

The requirement to file a tax return varies from country to country. In the United States, for example, individuals must file a tax return if their income exceeds a certain threshold set by the Internal Revenue Service (IRS). Additionally, those who are self-employed, receive income from rental properties, have certain types of investment income, or owe certain taxes (such as the alternative minimum tax) may also be required to file a return. It is best to consult the tax laws of the specific country or jurisdiction to determine the criteria for filing a tax return.

How to fill out return filing?

Filling out a return filing form will vary depending on the specific type of return you need to file. However, here are some general steps to follow:

1. Gather your documents: Collect all the necessary documents such as W-2 forms, 1099 forms, receipts, and any other relevant financial paperwork.

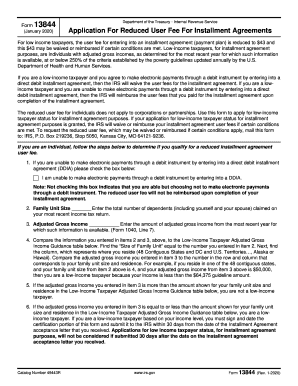

2. Choose the right form: Identify which form you need to fill out based on your filing status and income level. Common forms include 1040, 1040A, or 1040EZ for individual tax returns, or specific forms for business or self-employed individuals.

3. Fill in personal information: Enter your personal information like your name, address, social security number, and filing status at the top of the form.

4. Report your income: Provide details about your income sources and amounts. If you have multiple income sources, use separate sections or schedules as required by the form.

5. Claim deductions and credits: Deductions and credits can help lower your taxable income. Identify and enter the deductions and credits you qualify for, based on the instructions provided for each form.

6. Calculate taxes owed or refund due: Use the appropriate tax tables or calculations to determine the amount of taxes you owe or the refund you are eligible for.

7. Sign and date: Once you have completed the form, ensure you sign and date it to validate your return filing.

8. Keep copies: Make copies or take pictures of your filled-out return filing form and all supporting documents for your records.

Remember, tax laws and requirements can vary, so it's advisable to consult with a tax professional or use online tax software to ensure accuracy and compliance with the most up-to-date regulations.

How do I edit number tin in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your filing irs form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit return filing on an iOS device?

You certainly can. You can quickly edit, distribute, and sign return irs on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out form 8868 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 1127 a form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.